Get Out Of Debt In No Time With These Effective Tips

Some people think that getting out of debt on their own is impossible. They feel like they need to ask for help with their parents or family just to help them get out. But good news! There are still a lot of ways on how you can get out of debt on your own.

In this article, I will talk about how you can get out of debt alone because many people are having issues when it comes to their payables. They feel like they are going to be in debt until the end of time. The truth is, though, many solutions are available so you can pay them off. In fact, a friend paid a total of $70,000 in just three years. If he can do it, then so are you.

1.Know-How Much Your Debt Is

The first thing that you have to do is to know how much your total debt is. Some people tend to ignore how much debt they have because it stresses them out. But what you don’t know is that your debt is increasing by the month because of the interest rates. Yes, even if you paid the minimum required amount, there will still be interest rates until you paid it in full.

2.Know Your Debt To Income Ratio

Another thing that you need to know is to know your debt to income ratio. The computation differs, but you can always use free tools online so you can accurately compute it. For instance, if you are earning $40,000 per year, and your debt is $20,000, the total debt ratio is 0.5%. If you are earning $200,000 per year, and your debt is $350,000, your total debt ratio if 2.5%.

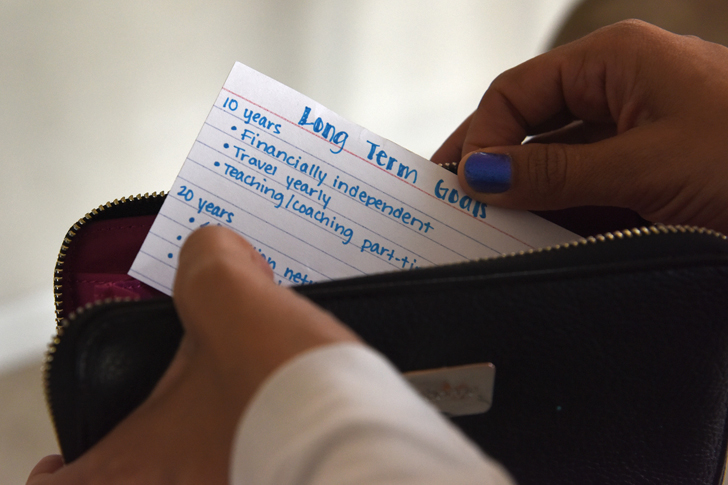

3.Start Changing Your Behavior

Know what happened before you got into this big debt. Remember how you got into this big mess. Once you have figured that out, the next thing that you should do is to avoid doing those things. Avoid going back to the way you used to be, which caused you to be in this in the first place. You need to make sure that you need to avoid spending on things that you couldn’t really afford. Avoid using your credit card on purchases that are not really important. It may be challenging to change your ways when it comes to money, but if you want to pay off your debt and avoid incurring more debt, you need to change.

4.Earn Enough

You need to make sure that you are earning enough to eat and pay off your debt. Remember to “spend below your means,” and you should put that in mind and in your heart. This will help you to save up from your earnings and use it to pay off your debt. In no time, you’ll be surprised that you already paid all off.

If your job is not helping you to pay the majority of your debt, you can get a side job to help you out. You can start looking for an online job, whether it’s being a freelance writer or being a photographer if you are into that. You can also sell some stuff that you no longer use to help you earn more.

Conclusion

With these tips, you will surely be able to pay all of your debts in no time. Avoid getting pressured with a timeline. What matters is, you are doing something to help pay off your debt.

Based on Materials from Money Under 30

Photo Sources: Independent.co, Fitsmallbusiness, Malmstorm Airforce Base